Bears got downright giddy today, as for an hour the most famous 50 day moving average in years seemed to finally be predictive of a price direction lower. But in the end, it was a non-event. S&P ended basically flat, the indicative value of the VXX was down 6 cents, and the VIX up 7 bps.

Everyone is still predicting that the 50 day is going to reject the S&P to some sort of target, fib level, or new channel, but it is not yet obliging. Resilient is an appropriate description for this market. While the S&P has been channeling the 1600-1620 range for the past week, don’t look now but a bullish MACD cross is about to occur:

S&P volatility has remained quietly under 17 for 4 days now, but the VIX futures are still expecting higher vol. In fact the open interest in the SPY options is 2-1 puts to calls:

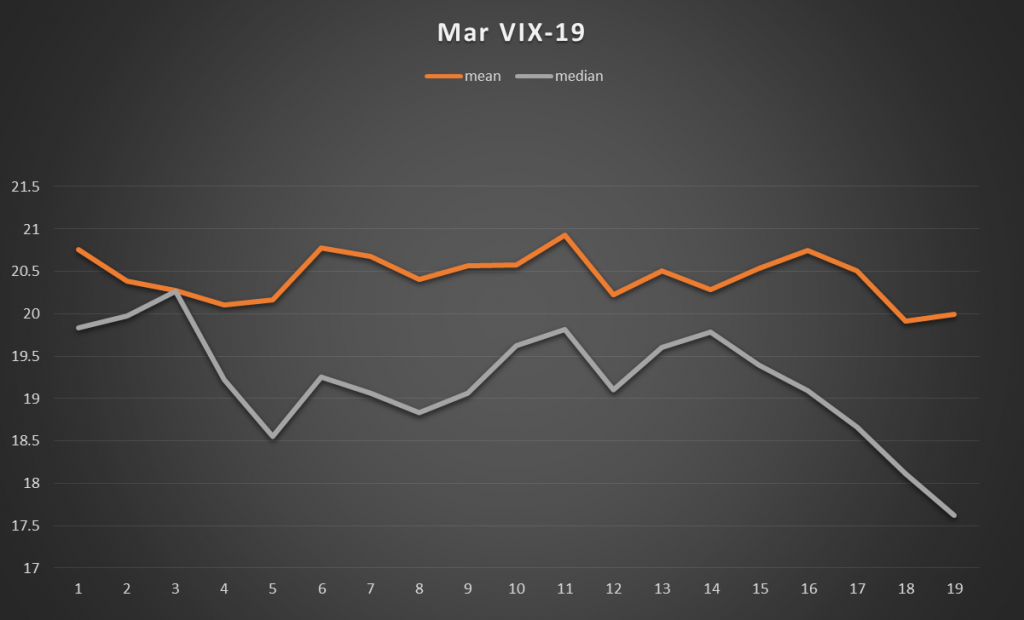

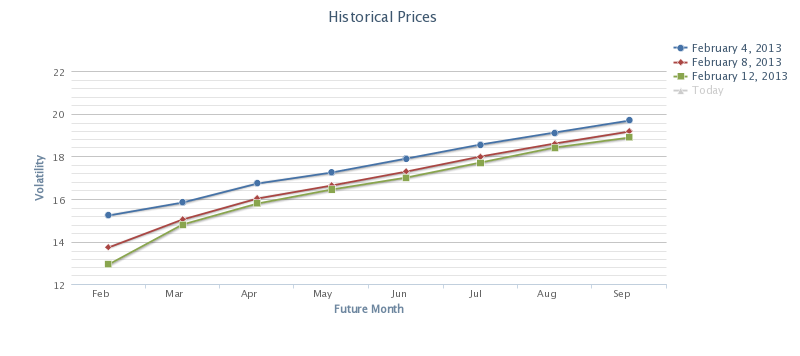

Why are the futures trading this high above spot VIX with 8.5 trading days to expiration? I would have thought that they would have fallen closer to spot by now, with all the time decay in the offing, although there’s that job number out there on Friday. Could there be another volatility exhale after that number satisfies the market by being good, but not too good?

| Symbol | Contract | Month | Time | Last | Change | Open | High | Low |

|---|---|---|---|---|---|---|---|---|

| VX N3-CF | S&P 500 VOLATILITY | July2013 | 16:15:00 | 17.55 | -0.10 | 17.40 | 17.95 | 17.05 |

| VX Q3-CF | S&P 500 VOLATILITY | August2013 | 16:15:00 | 18.45 | 0.00 | 18.30 | 18.80 | 18.05 |

| VX U3-CF | S&P 500 VOLATILITY | September2013 | 16:15:00 | 19.45 | 0.05 | 19.35 | 19.60 | 19.00 |

Who knows, but one thing is certain. Until the market sells off and the VIX rises, the VXX will have a tough road to hoe. I am still long a few $18 July puts, almost just to see how this decay/jobs number/50 day resolves itself. If for some reason, Friday goes well and the market breaks the 50 on it’s fourth attempt, these puts could double. If it doesn’t, then they will still have some value and I will look to exit near my cost. It is an asymmetric risk/reward at .14. Keep in mind that these puts have 3 days more life than the VIX futures.

But that is a minor position after we closed all our $19 puts for a 100% return. Other trades tweeted out this week include:

Short GLD weekly call spread, 122.5-124.5. Sold for .40, now .27

Short SPY weekly call spread, 163.5-165. Sold for .44, now .10

Sold VXX weekly call spread, 22-24. Sold for .52, now .05.

Sold VXXÂ July 12th call spread, 20.5-22.5 for .40, now .44

Long UCO July puts for 1.05, now 1.15. Oil could fall dramatically with equity selling or Egypt resolution. It is at the high of the year on bearish fundamentals.

It has been a great week, all trades are working. This is a great environment to sell volatility. I do not anticipate any trading tomorrow if the open is not a significant gap.

Follow trades @VolatilityWiz on twitter and have an awesome holiday. We may post Friday should there be some job-related drama.